The Permanent Challenge of Temporary Declines

With higher inflation now a reality in many developed economies, ongoing geopolitical conflict in Ukraine, and renewed trade tensions under President Trump, the possible triggers for market volatility are many.

And 2025 has certainly delivered.

In April, both the S&P 500 and the MSCI World Index saw sharp drawdowns, roughly 10% and 9% respectively, following the unexpected announcement of new US tariffs. It was a reminder that markets can react swiftly to political and economic uncertainty.

Although both indexes have since recovered and gone on to hit all-time highs by September, this type of volatility is a permanent feature of investing.

While it’s tempting to view these moments as outliers, they are in fact entirely normal.

To prepare you for the probability of more and deeper declines in the months and years ahead, we’ve outlined a few key ideas that may help you stay grounded when others are losing theirs.

What You Should Know

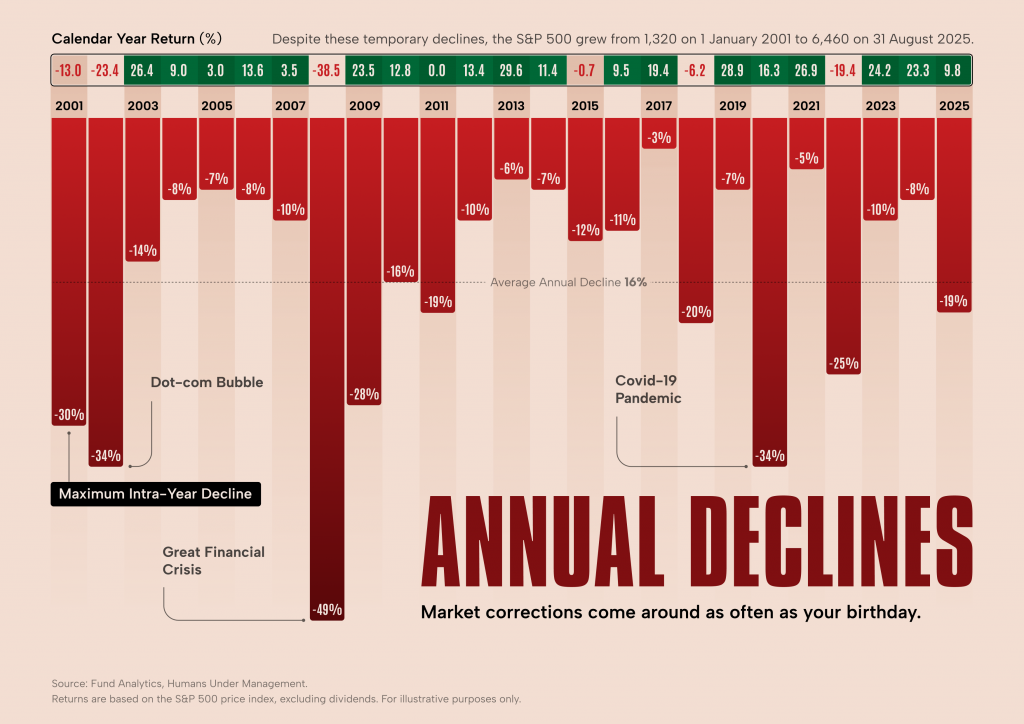

A market correction is defined as a 10% decline from a previous high. While that might sound like a significant drop, corrections are more common than most investors realise. They occur about as often as your birthday, nearly every year. Years like 2021, where markets were unusually calm, are the exception, not the rule.

Over the past few decades, the average intra-year market decline has been around -14%, yet most of those years still ended in positive territory.

Every five years or so, markets tend to deliver a deeper fall, somewhere in the region of -30% or more. We saw this in:

- 2020, with a pandemic-driven drawdown of -34% which finished the year 16% in the black.

- 2022, a brutal year for both stocks and bonds, which bottomed out at -25% and marked one of the rare moments when diversification failed. Finishing the year down 19%.

- 2024, with a more modest but still unsettling decline of around -8%, yet it ended with a 23% gain.

These kinds of declines are not anomalies. They’re part of the rhythm of investing.

Markets don’t move in straight lines. They fluctuate around a long-term upward trend. That fluctuation is what we call volatility, and it’s not going away.

Unfortunately, no one can reliably predict when the next drop will come or how deep it will be. To be a successful long-term investor is to accept this with humility.

How You Should React

When we perceive a threat, our instinct is to run. It’s how we’re wired. But a market decline is not a predator. It’s not a fire, a flood, or a crisis that demands escape. It only becomes dangerous if you panic.

Market declines are a regular part of life. Your mindset when they happen will determine your outcomes far more than the decline itself.

You have the advantage of being a long-term investor. That means you’re playing a completely different game than the traders and news cycle followers. What happens in the next 30 days has little relevance to your 30-year plan.

Over the long term, the odds are stacked in your favour if you stay the course.

Markets produce positive returns roughly three out of every four years. The losing year earns you the other three. It’s the cost of admission for participating in global growth and innovation.

Temporary declines are not in the way of long-term returns. They are the reason those returns exist.

Time Heals

The stock market is a tool that transfers money from the impatient to the patient.

When prices fall, long-term investors don’t lose. They accumulate. If you’re still saving, market drops are your friend. They let you buy more of the same investments at cheaper prices, boosting your long-term return.

Investing success requires rational thinking under uncertainty. That’s not always easy. But the alternative, reacting emotionally and abandoning your plan, almost always leads to worse outcomes.

We encourage you to stick with your plan, lean on your advisor, and stay focused on what really matters.

We don’t know where the market will be six months from now. But we have a good sense of where it will be in ten years: likely much higher.

Time is the enemy of market declines, and the ally of every patient investor.

👋 Need Reassurance?

If you’re ever unsure whether your portfolio or strategy is still aligned with your goals, you don’t have to guess.

That’s what we’re here for.

Let’s work the plan, not react to the noise.